ter or click to view image in full size

Did you know, if you’ve ever opened a margin trading account, chances are you’re overpaying — by a lot? You might think all brokerages charge roughly the same interest, but that’s a costly illusion.

In 2025, the real interest rate for margin trading can go as low as 3.3% to 3.5% — but almost nobody gets that rate by default. Why? Because you’re not meant to.

Unless you negotiate directly with an account manager, your account will automatically default to the highest retail rate — sometimes 5.8% to 8.35%, depending on the platform. That’s the difference between a smart trader and a sheep being sheared.

Forget the Sales Talk — Interest Rate Is Everything

All that talk about “great service” or “exclusive bonuses” when opening a trading account? It’s marketing noise. Service means they’ll push more financial products at you — and when you lose money, they’ll shrug.

Bonuses? Those are just your own money repackaged with extra fees and inflated rates.

The real metric that matters — the only thing that actually affects your profit — is the margin interest rate. Because in margin trading, every 1% you save on interest directly boosts your net return.

Understand the Margin Trading Structure

There are two main directions in margin trading:

- Financing (Margin Buy): Borrowing money from your broker to buy stocks, hoping they rise.

- Short Selling: Borrowing stocks to sell them first, then buying them back cheaper later.

In both cases, you’re leveraging borrowed capital, and the cost of borrowing — the interest rate — determines whether your strategy makes or loses money.

The difference between a 3.5% rate and a 6.5% rate can be the difference between compounding profits and bleeding out over time.

The Hidden Rule — Bigger Capital, Better Rates

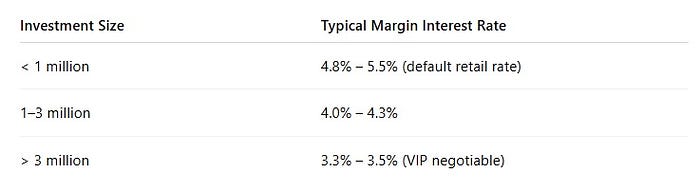

Brokerages don’t tell you this, but their “rate tiers” are all about fund scale.

Here’s the inside view:

This means that the more funds you hold, the more leverage you have — literally and figuratively.

If you’re trading large, always negotiate directly with your account manager. Don’t rely on the default online onboarding form — that’s how you end up stuck at 8%.

Don’t Get Fooled by “Standard Rates”

One of the biggest traps in margin trading is the information gap. Offline customers often walk into a brokerage and open a margin account without inquiring about interest rates. The result? They are slapped with 5.8% to 8.3%, while someone who applies online through an account manager quietly receives 3.8%.

This happens because most brokers won’t tell you that you can negotiate.

They only lower rates when you ask.

First, before funding your account, ask your broker directly for a “financing rate review.” Fight at 3.5% or below but be polite and firm, and if you don’t get a satisfactory reply, escalate to a higher-level manager or consider another platform.

Fund Custody and Credit Commissions — The Other Hidden Costs

You’ll also pay commissions on credit transactions, so know the rates.

Commission rates can be 0.85–1.5 per $10,000, but you can negotiate down to 0.65–0.74.

That might sound small — but for frequent traders, that’s hundreds of thousands in extra costs every year.

“Interest is what kills long-term gains. Commissions are what bleed you daily.”

Margin Trading = Double-Edged Sword

Margin trading amplifies gains — but also losses.

Before using leverage, ask yourself:

- Can you survive a 15% drawdown without a margin call?

- Do you understand the liquidation threshold?

- Do you have a strategy, or just FOMO?

Margin isn’t evil. Misused margin is. Margin trading isn’t just about picking the right stock. It’s about controlling the cost of your leverage.

No comments:

Post a Comment